The global aluminum market is a complex ecosystem driven by supply, demand, trade agreements, and technological change. For decades, aluminum imports into the United States have been a cornerstone of supply stability, ensuring industries like construction, transportation, packaging, and aerospace have the materials they need.

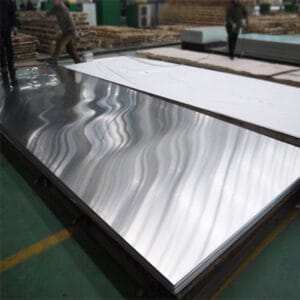

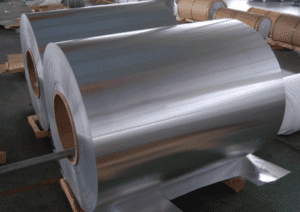

Although the U.S. has domestic smelting and recycling capacity, its production is far below demand. Semi-finished products such as aluminum tube, aluminum coils, aluminum sheet, and aluminum bar are consistently imported to fill the gap. In this article, we break down the trends, suppliers, challenges, and opportunities shaping America’s aluminum import market.

Why Aluminum Imports into the United States Matter

The United States ranks among the world’s largest aluminum consumers, using more than 6 million metric tons annually. However, U.S. smelting capacity has declined sharply since the early 2000s due to high electricity costs, environmental regulations, and international competition. As of 2023, the U.S. accounts for less than 2% of global primary aluminum production.

This structural shortfall explains why aluminum imports into the United States are not optional — they are essential. Imports provide:

- Supply security for sectors like aerospace and automotive.

- Cost stability by diversifying sourcing across multiple countries.

- Access to product forms not widely made domestically, such as high-grade aluminum coils for roofing or specialized aluminum tubes for energy equipment.

Without imports, industries from beverage packaging to aircraft manufacturing would face severe bottlenecks and higher costs.

Top Sources of U.S. Aluminum Imports

The U.S. has built long-term partnerships with certain supplier nations:

- Canada: The largest source, supplying nearly 50% of U.S. aluminum imports. Proximity, hydroelectric-powered smelters, and USMCA trade protections make Canada a reliable partner.

- United Arab Emirates (UAE): Operates one of the world’s largest aluminum smelters (Emirates Global Aluminium), exporting significant volumes of ingots and semi-finished products.

- Russia: Once a major supplier, now reduced due to sanctions, which has forced U.S. buyers to seek alternative sources.

- China: Dominates the global aluminum industry but mainly exports finished and semi-finished goods like aluminum sheet and aluminum coils rather than raw ingots.

📌 Source: U.S. Geological Survey (USGS) – Aluminum Statistics

The Role of Imports in U.S. Aluminum Industries

Imports shape nearly every major aluminum-using sector:

- Construction: Relies on aluminum coils and aluminum sheets for siding, curtain walls, roofing, and interior design applications. Lightweight yet durable, imported coils help meet demand in both residential and commercial projects.

- Automotive & EV Manufacturing: Automakers use aluminum bar and aluminum tube to reduce vehicle weight and improve fuel efficiency. As EV adoption grows, demand for tubular extrusions and structural bars is rising.

- Aerospace: Aircraft manufacturers require specialized alloys with tight tolerances. These often come from imports because not all grades are produced domestically.

- Packaging: Aluminum sheet is indispensable for cans and foil. In fact, over 40 billion aluminum beverage cans are filled in the U.S. each year, much of the raw material being imported.

Internal links for product categories:

Trade Policies and Tariffs

Government policy plays a decisive role in determining the volume and price of aluminum imports into the United States. The Section 232 tariffs introduced in 2018 imposed a 10% duty on imported aluminum to protect U.S. producers. While these tariffs supported domestic smelters, they also raised costs for manufacturers relying on imported aluminum coils and aluminum sheets.

For industries like aerospace and construction, where imports are irreplaceable, such policies often lead to higher end-product prices. Some exemptions (such as Canada and Mexico under USMCA) mitigate these effects, but trade negotiations remain a balancing act between protecting jobs and securing supply.

Future Outlook for Aluminum Imports into the United States

Several forces will shape the future of aluminum imports:

- Energy Transition: The rise of electric vehicles, renewable power systems, and lightweight transportation will boost demand for aluminum tubes and bars in battery housings, charging infrastructure, and lightweight vehicle frames.

- Green Aluminum: More buyers are seeking low-carbon aluminum from hydro-powered smelters in Canada and Norway. Imports will increasingly be judged on carbon footprint, not just cost.

- Recycling Expansion: Secondary aluminum, produced from scrap, requires only 5% of the energy of primary production. The U.S. is ramping up recycling, but demand growth still makes imports necessary.

- Geopolitical Risks: Trade conflicts or sanctions may redirect supply chains. Diversification will be a critical strategy for importers.

📌 Resource: London Metal Exchange (LME) – Real-time global aluminum pricing

Opportunities for Businesses and Buyers

Businesses importing aluminum products can secure long-term competitiveness by:

- Partnering with multiple suppliers to mitigate risks.

- Tracking global price indices to optimize purchasing cycles.

- Exploring green aluminum options to meet sustainability goals.

For wholesalers, promoting high-demand products like aluminum coils for construction or aluminum tubes for industrial machinery ensures stronger market positioning. Buyers should also leverage trade intelligence platforms to stay ahead of tariff changes and demand shifts.

Conclusion

Aluminum imports into the United States will remain vital to supply chains for the foreseeable future. While domestic recycling will expand and green policies will reshape sourcing, imports of aluminum sheet, aluminum coils, aluminum tube, and aluminum bar will continue to underpin U.S. industries.

Companies that understand the evolving trade landscape — and act strategically — will gain the greatest advantage in a market where aluminum is not just a commodity, but a foundation of modern industry.